Preface

Earlier this month we gave a talk at FWB FEST that expanded on the Nemesis Guide to Being Early memo we published earlier this year.

Here’s our presentation, edited for legibility. We think it’s worth your time even if you’ve read the original – a lot has happened since :)

In February we published a memo titled The Nemesis Guide to Being Early. What prompted the writing of it was an observation that ‘being early’ had become an increasingly dominant meta, cultural strategy, and source of stress in terms of one’s personal positioning in culture, the economy, and beyond.

(meta = most effective tactics available)

Following this, it also so happened that ‘earliness’ or a sense of being early had become an important way in which brands related to their audiences.

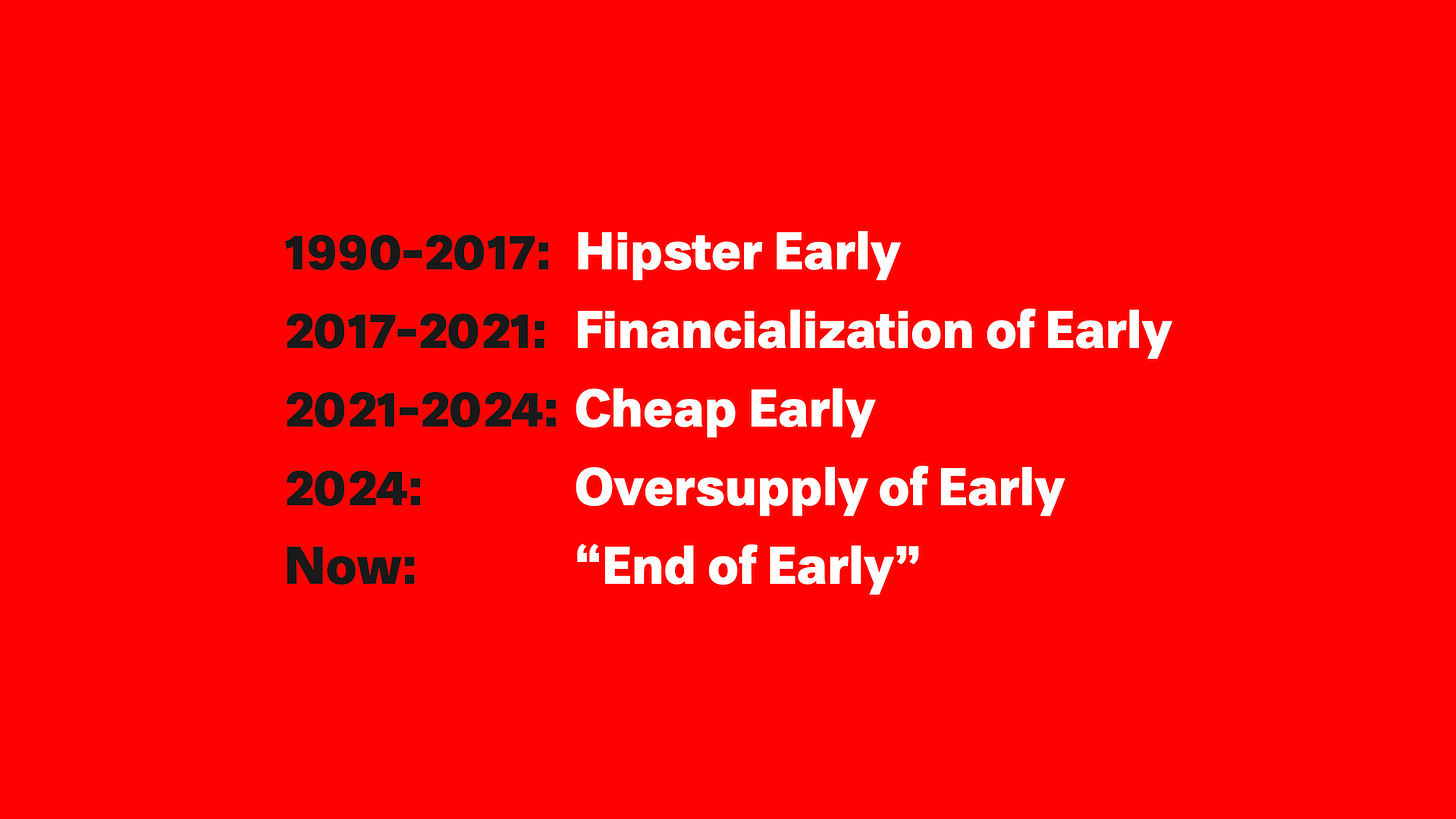

In this update we’ll provide additional color to the constantly evolving meta of being early and attempt to map out how ‘earliness’ has evolved as a cultural strategy over time.

This memo will be a bit different for us as we assume there’s a bigger crypto native contingent – or at least a higher general crypto literacy in the audience. If you’re not, bear with us :)

We have all known people who are born chronically early, with some sort of time signature distortion. These people receive zeitgeist signals much earlier than everyone else. They are artists and writers, music people, roommates, otakus, traders…

Those who are truly early are cursed, they are too early to make hay, make money, make sense of it – i.e. they are functionally wrong. By the time other people catch on, they're annoyed.

There’s something indie, hipster, generationally specific about this: a fundamental relationship to the curatorial flaneur, interested in this and that, then disinterested just as the uncultured masses sweep in and make that thing big, popular and probably profitable.

“Do you want to be right or do you want to make money?” was a popular 2021 Crypto Twitter catchphrase. In its original context, it’s a call for mental flexibility as the market starts to move against your investment thesis or contrarian posing. The market might be “wrong” in your opinion, but you learn to accept that, reposition and make money.

But the statement also captures something essential about the evolving reward function of being early.

Let’s take the prototypical 2000s hipster.

The hipster wanted to be right in their aesthetic, cultural and consumption choices. They wanted to be first to a thing that’s unique. Finding a thing before others was valuable in itself.

But even if the hipster hated for their discoveries to go mainstream, validation and value still derived from others subsequently discovering it; others who could recognize and reward their earliness. The competitive set was small, consisting of other snobs like themselves.

Arguably the prototypical hipster doesn’t really exist anymore. Now we have, for the lack of a better term, creative directors.

The creative director differs from the hipster in the fundamental way that ultimately, the creative director wants (and perhaps even more so, needs) to make money. Being early and reveling in obscurity carries limited value to them.

To them – or to us – being early is just one of the better metas to establish a position in something when it’s still cheap, and profiting once a critical mass discovers it.

While the hipster hides and protects their discoveries, the creative director shills them: as a consultant, as a meme trader, as a curator etc.

There’s a clear, generationally coded value drift from “hipster earliness” to “creative director earliness”; from a desire to be right, to a desire, or need, to profit.

We think crypto plays a big part in this shift, where ‘earliness’ has become culturally – and literally – financialized.

How did this happen?

Early crypto, let’s say 2012-17, had a significant hipster contingent living and breathing the intersection-of-art-and-technology.

Crypto’s appeal was:

You could buy drugs with it (real life utility)

It was a counter-cultural obscure internet culture you could discover before others and trade this knowledge for clout (rather than actual money)

It was a genuinely new thing in culture and technology

As hard as it is to believe now, the financial speculation aspect wasn’t really part of the equation for many early enthusiasts.

Vitalik Buterin, the key founder of Ethereum, did a talk at the Swiss Institute – an art institution – in New York invited by writer Sam Frank in 2014, a bit after the Ethereum ICO.

Martti was there with a bunch of art hipsters like himself and confirms not many of them saw the opportunity to buy the future of the internet for 30c per token. Quite the opposite; the Wall Street sharks circling Vitalik after the talk were sneered upon.

But of course not everyone missed the opportunity.

2017 saw the first crypto boom where it caught mainstream attention and made many early participants fabulously rich. Many others, many of them hipsters, had to accept they had in fact really been early to something yet had missed the financial opportunity of a lifetime – having had no idea it was there in the first place.

Before this, being early to niche things meant primarily winning points in a subcultural status game, now it was suddenly associated with very real material and financial consequences.

Now indie psychology became electrified, as previous regret could potentially be mined and turned to money. The idea that you were into something before anyone else could finally become financially profitable.

What if cultural brands or products were tokens that rewarded earliness? A popular concept was that you could buy tokens associated in convoluted ways with cultural products you were interested in (memes, brands, creators, influencers, etc.) and disproportionately profit once they became popular later on.

Ironically, the crypto hipsters were again too early for their own good as these ideas didn’t fully pan out during this period. Instead, many of them were later co-opted by prominent venture funds and others as the web3 creator economy narrative.

This pattern continued throughout the 2017 crypto mania as there was a disproportionate focus on trying to make it via the most obscure tokens and esoteric narratives. “Do you want to be right or do you want to make money” hadn’t fully rewired the hipster brain yet.

With the benefit of seven years of hindsight, we think this period ended up being a watershed moment where a collective mental shift began and earliness lost its innocence.

Being early wasn’t anymore a battle for clout, but a strategy to make it.

Being-early-as-a-service is a concept coined in 2022 by CT personality Cobie, that really nails the actual product market fit of crypto.

Everyone knows how those who got in early experienced one of the most insane repricings of any financial asset ever. With this in mind, as well as many other 1000x-ers since then, in theory, every new token carries within it the potential for a similar gain. Their main value proposition is allowing one to be early to a new thing; i.e. being-early-as-a-service.

Brands that offer earliness as a service often turn you out, make you into a shill or an evangelist for them. This is, of course, the ponzi dynamic. To shill or be shilled – are you late or are you early? If you’re early it becomes your job to evangelize, to get the show on the road. The brand infects you to proselytize.

Each unique brand is ‘early’ only once in its lifecycle before it’s superseded by a newer one. As the cost of creating new things is essentially approaching zero, being-early-as-a-service is challenged by the constant production of novelty. From crypto to dropshipped instabrands to alt accounts to research chemicals etc. – there’s constant dilution of the new.

Last year at Nemesis HQ we noticed a change in how we relate to crypto brands: we hardly visit project websites or encounter ‘official’ brand identities anymore. Brands exist primarily as names and tickers, UGC and memes on Twitter. They are constructed out of less original source material than ever before.

In the absence of anything genuinely novel in terms of technology or product, crypto brands exist mainly in relation to each other and derive most of their ‘meaning’ from the vertical or associative constellation they are lumped into.

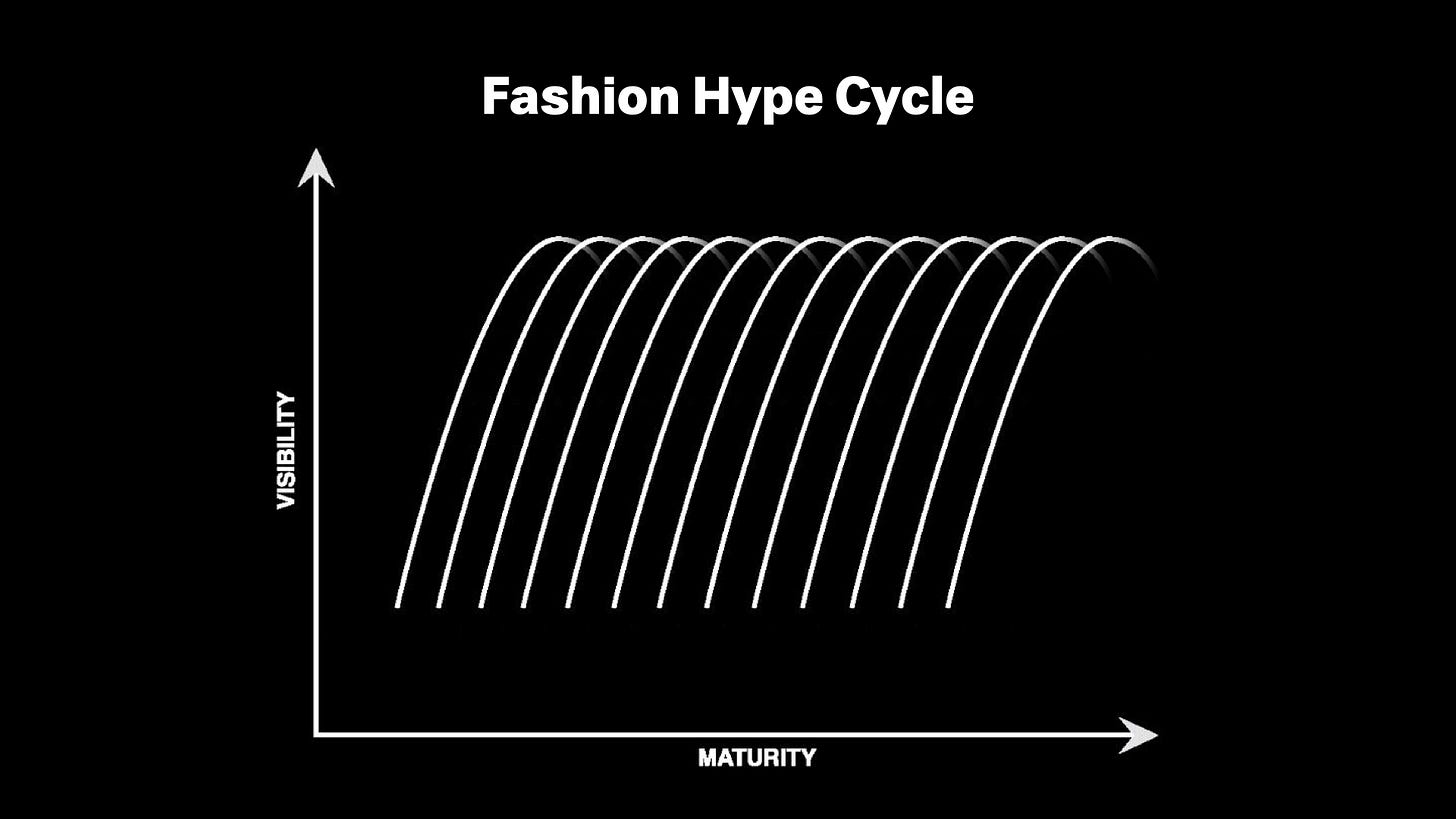

In crypto many subscribe to the mental model of the tech hype cycle, but this is mostly incorrect. In crypto things very rarely reach the plateau of productivity, more often falling straight to zero straight through the trough of disillusionment.

In fact, reality looks more like our fashion cycle model, with its shepard tone-like dynamics, in which each new thing is supplanted by another shiny new thing, and no path to productivity emerges.

We only notice the spectacular rise of things while in the background things quietly go to zero. We only witness the earliness; no one follows up on the hyped project of yesterday.

BUT…

(A new thing can be a brand, aesthetic novelty, tokens, or something else all together.)

The original memo The Nemesis Guide to Being Early came out in February this year. We ended it with the statement:

“The next big thing might already be here, and it just might end before it ever really began”

Turns out we should’ve had more conviction in our ideas, as they would play out at an insane scale and speed over the following months.

We’re of course talking about meme coins.

More tokens have been deployed between February 2024 and today than between the launch of Bitcoin in 2009 and January 2024.

But why now?

The rise of cheap chains and L2s, particularly Solana, token launch platforms like pump.fun and a generally positive market environment allowing for speculation. But most importantly, everyone had learned a new meta, and that reflexively fed on itself.

So what is, or was, the meta?

In crypto markets there are certain beliefs regarding how coins “ought to pump”.

First goes bitcoin. Then as the profits from its rise are reinvested, the pump moves in an orderly fashion from bigger and more established coins to smaller ones down the risk curve. At the very end are meme coins which are the riskiest but also known to “pump the hardest”.

In 2023 most market participants still believed that a degree of the pretension of “real world utility” was necessary for a token to reach serious valuations.

However, in early 2024 it became increasingly evident that the feeling of being early could be sold on less and less, to the point where the only thing left was the question: are you early to this thing or not? Who’s going to be late?

So, in February 2024, having seen the success of meme coins such as PEPE, BONK, WIF and others that came up during 2023 and early 2024, it was completely rational for market participants to try to front-run the traditional gateway theory of token pumps and jump directly to the hard stuff, i.e. memes.

As simultaneously (thanks to pump.fun) the cost – in terms of money and technical knowledge – of launching new tokens rapidly approached zero, it set the stage for a race to exploit the meta while it was still in play.

Over the course of this meme season we saw a compression of time between:

Accelerating the meta further, the “pure potential” window of a new coin was ultimately reduced to seconds, as it was sniped by a bot sandwich attacked by another bot.

At this stage there weren’t enough new participants left to support this extreme oversupply of earliness and the vast majority of coins were dead on arrival. The meta ate itself. No one wanted to be late.

But these dynamics don’t just apply to meme coins, but also to culture at-large. In fact, we think there’s a bigger call to made here:

Logically, what follows is a new meta of even more accelerated front-running, in both culture and markets. And yet, this meta begins to collapse on itself, as you can’t be early if the thing you’re front-running is front-running you in a recursive spiral.

The multi-armed bandit is a useful mental model in the context of this meta collapse.

The MAB is a problem an agent faces when simultaneously attempting to acquire new knowledge ("exploration") and optimizing their decisions based on existing knowledge ("exploitation").

Imagine you’re at a casino. In front of you there are several slot machines i.e. one-armed bandits. You know some of them will pay out more than others but you don't know which. Do you spend your coins trying out the different slot machines or do you go all in, playing the one machine that seems to pay the most? How much time do you spend exploring vs. exploiting?

There are tons of practical examples of this problem.

How many people do you date vs settling with someone?

Do you eat at the same restaurant you love every night, or do you become an adventurous foodie exploring *hidden gems*

Or: a year or two ago maybe a quarter of pop EDM sampled, borrowed or interpolated an existing old hit.

Turns out losing 50% of royalties to the original songwriter is still worth it, because any degree of pre-recognition makes a song much more likely to get streams and radio play.

Quickly everyone understands the meta and now virtually all contemporary pop music (EDM, rap, etc.) does it. There’s no new music.

So if we live in a world where cultural and financial metas become known and exploited faster and faster it is better to wait and see what sticks and double down on exploiting it, rather than risk wasting time exploring new strategies.

On one end of the bandit spectrum (MAX EXPLOIT) you risk missing out on a better thing, on the other end (MAX EXPLORE) you risk wasting all your time chasing it. Currently we’re leaning heavily on the missing out end of the spectrum.

In this world being early is a liability as you’re most likely (functionally) wrong. The premium on absolute novelty turns into a discount. The faster everyone optimizes for the exploitation of the most recent proven meta, the faster they will get crowded and die out.

So, to come back to what we said earlier: If the meta is being early, and everyone knows the meta is being early, everyone will try to front-run each other. And when everyone is scrambling to get in front of others, it breaks any recognizable waves or trends before they reach a critical mass or coherence. This produces a kind of illegible, chaotic chop which many of us are familiar with.

It’s the end of trends (something we wrote about in 2020).

Being early is valuable only if someone else is willing to be late. If nothing, or only very few things, are able to cross the chasm to some level of sustained existence, it’s better to wait for the few things that do, accept that you’re late-early or early-late, and double down on it – whether it’s Dogwifhat, or Balenciaga in 2018. Everything that’s not dead is doing something right.

But be warned: even if you do the seemingly smart move of waiting for something to break out and establish a trend before joining it, it is increasingly difficult to identify those that can sustain for a longer period of time as most “breakout trends” turn out to not be actual breakouts.

WAGMI was premised on an optimistic delusion of a rising tide lifting all boats. A world that’s not purely PvP but one where we can “all” ride a wave to a better place (i.e. profit). Of course WAGMI was always a dubious notion, but at this point it has essentially become a physical impossibility as we’ve collectively killed the possibility of the one big wave that could everyone. “Retail learned too many lessons”, or, the world learned too much about itself to not go full PvP.

So, to summarize of our brief history of early:

Where do we go from here?

Of course, time hasn’t disappeared. Things still happen and you can be early or late to them. But earliness itself is a decreasingly relevant way for a brand to relate to its audience or as a strategy for individual positioning.

Once front-running other participants in financial markets or cultural production becomes a common strategy, trends become inefficiencies – temporary blips of difference or spikes in value that are bound for correction. Being early as a meta is replaced by catching people offsides. Betting on the return to the mean.

This is now where savvy meme traffickers, cultural operators and traders focus – on deviations from the norm rather than substantial shifts. Moments that might spike the dopamine or capture the imagination of just enough people to proverbially dump on them.

So what’s the play here?

Instead of exploiting early, this might finally be the time to max explore what's right in front of you, right now.

x

Nemesis

Being early is often a curse

This speaks to our little crypto side project so much. It's not like we are completely ideologically driven but we are deliberately trying to be successful (even if it's just somewhat) in a way we feel comfortable and positive with.

If we can't do that, we figure the thing we tried to do has failed. There's no desire for a pivot in the team.

I suppose that's the advantage of not having something be your day job.